Adding Perdoceo Education To My Value Portfolio (NASDAQ:PRDO)

Trevor Williams

Today I’m adding a company to my value portfolio that I believe has become a value play largely due to it being in the much hated “for-profit higher education” sector. This sector has been in the crosshairs of regulators for a number of years, so there is definitely cause for caution (see Risk section below), but as I discuss herein, I think the company fundamentals and trends are such as to warrant taking an initial long position in the company.

Perdoceo Education

Perdoceo Education (NASDAQ:PRDO) is a for-profit postsecondary education company with two accredited academic institutions. It attempts to differentiate itself by using technology (including artificial intelligence) not just for its teaching aspects but more importantly for supporting students to ensure higher graduation rates and better overall student satisfaction.

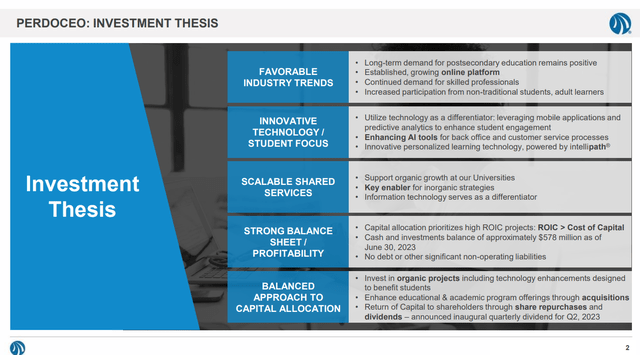

PRDO’s latest investor presentation features several well-done slides that quickly summarize the company and the overall investment thesis.

Here’s an overall view, highlighting both the technology aspect and the valuation/shareholder focus. I will discuss the latter further down in this article.

Investor Presentation

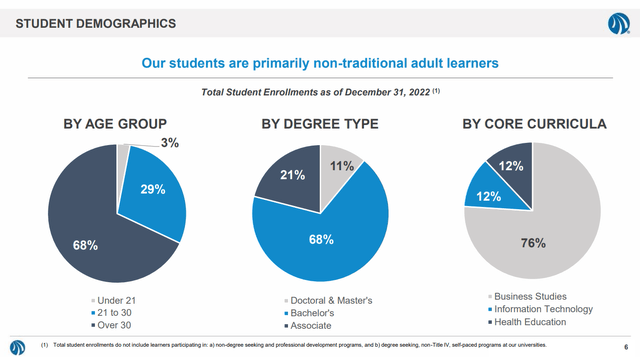

The company also tries to differentiate itself by pursuing adult students, for example, as shown below, over two-thirds of its students are over 30 years of age. To me at least, this student demographic is more certain of what it is trying to achieve by getting additional schooling and probably less likely to abuse student financing or to get into other financial quandaries (which somewhat mitigates the regulatory risks the whole industry faces):

Investor Presentation

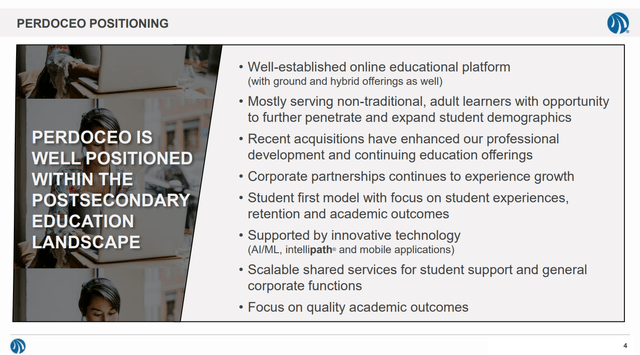

The company now hopes to leverage the infrastructure it has created by building on corporate partnerships and using recent acquisitions to expand the professional development-type courses it can offer its entire student body. This, in my opinion, is a new and interesting potential future growth path.

Investor Presentation

Recent Operating Results

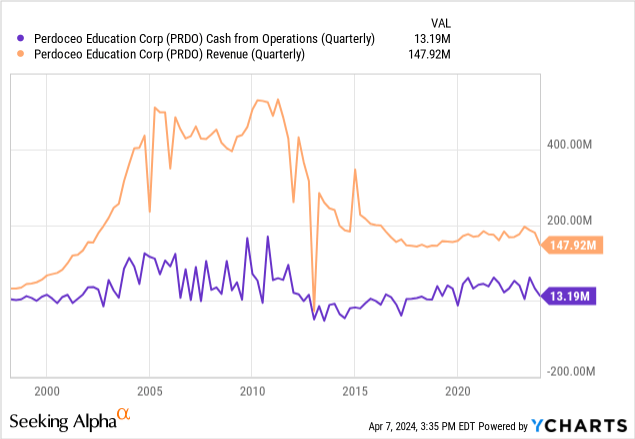

Despite operating in a regulatory environment that is hostile to for-profit educational institutions, PRDO has had relatively steady to slightly declining revenues and cash flows from operations.

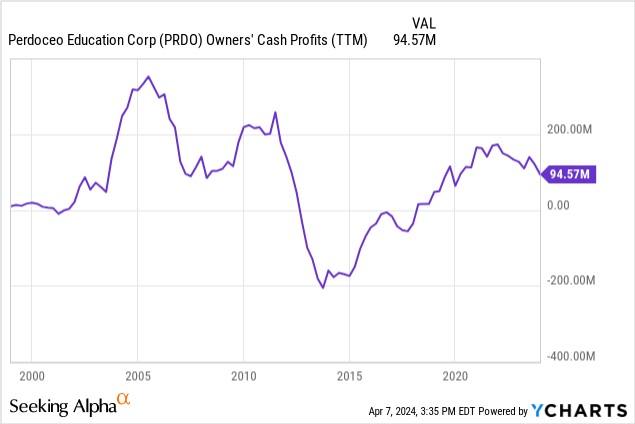

Owner’s cash profits have also been climbing since their nadir in 2015.

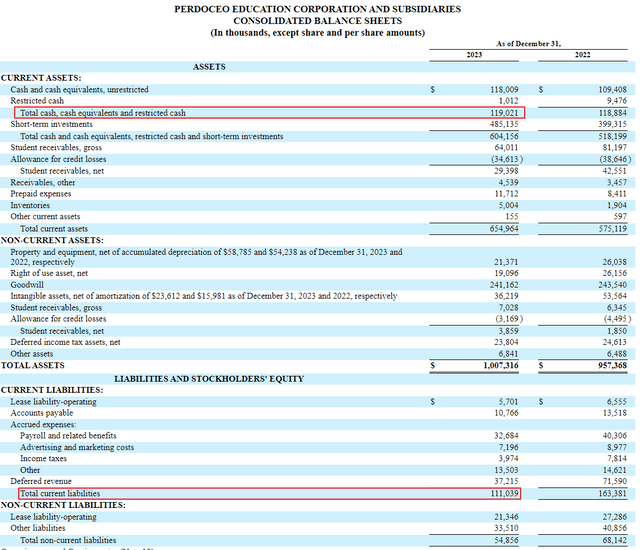

Cash on Hand

The positive cash flows have resulted in a benign cash position with cash on hand of about ($119M/65.6M) $1.82 per share and another ($485M/65.6M) $7.39 per share in short-term investments on the balance sheet. These numbers provide substantial coverage of the company’s current and total liabilities.

10K

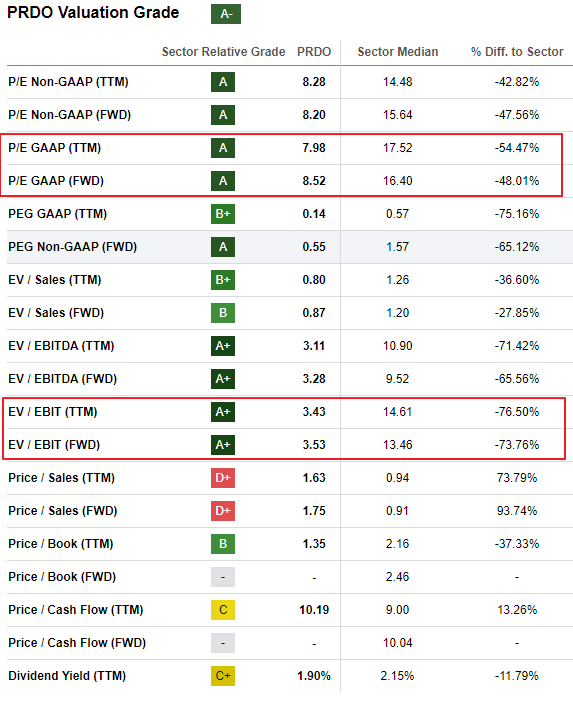

Valuation

With the stock trading at $17.39 per share, here is Seeking Alpha’s very helpful valuation summary. I’m particularly impressed by the P/E and EV/EBIT metrics.

Seeking Alpha

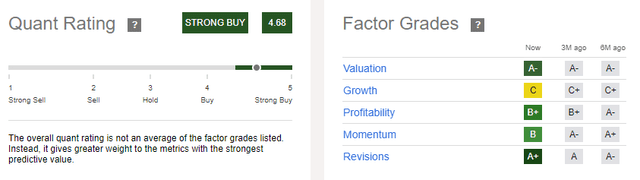

Quant Ratings

When selecting value plays, I always like to get confirmation from Seeking Alpha’s quant ratings and factor grades, and as shown below, these confirm that the company hasn’t shown much in the way of growth recently (though that may change going forward) but otherwise, the valuation and quant ratings are excellent. In fact, SA agrees with my strong buy rating.

Seeking Alpha

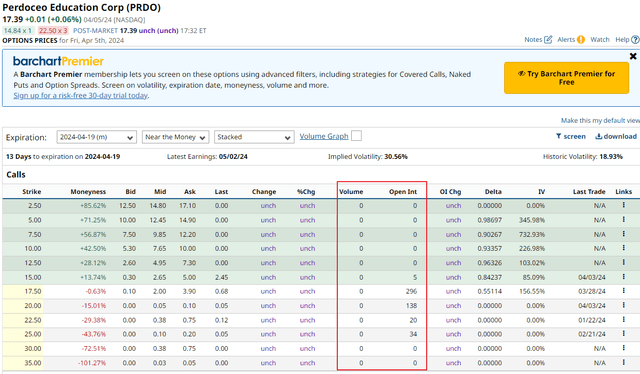

Options

PRDO trades options, but as shown by the open interest and volume columns below, the liquidity is quite poor. Nonetheless, it might be possible to accumulate a small long position via longer-dated calls.

Barchart.com

Risks

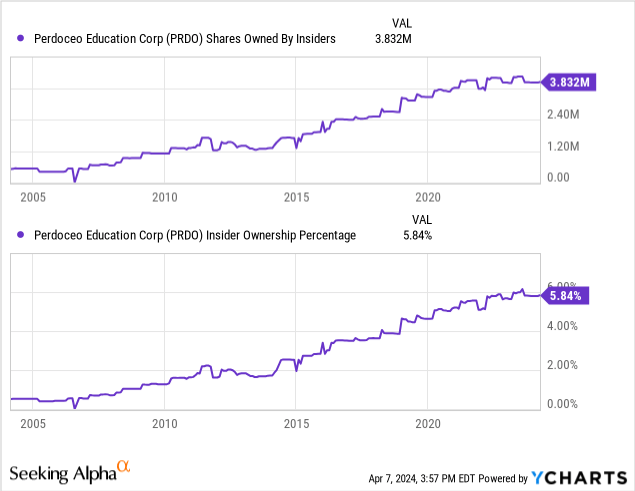

A previous Seeking Alpha article on PRDO rated the company a Hold based on several risks, the two foremost of which were regulatory scrutiny and insider sales. I agree completely with the first, but not necessarily with the second.

I’ve alluded to the regulatory risk throughout and was actually very happy that PRDO’s 10K took up the subject head-on. Here’s what they said with my emphasis:

Scrutiny of the For-Profit Postsecondary Education Sector

In recent years, Congress, the Department, states, accrediting agencies, the Consumer Financial Protection Bureau (“CFPB”), the FTC, state attorneys general, consumer advocacy groups and the media have all scrutinized the for-profit postsecondary education sector. Congressional hearings and roundtable discussions were held regarding various aspects of the education industry, including issues surrounding student debt as well as publicly reported student outcomes that may be used as part of an institution’s recruiting and admissions practices, and reports were issued that are highly critical of for-profit colleges and universities. A group of influential U.S. senators, consumer advocacy groups and some media outlets have strongly and repeatedly encouraged the Department, DoD and the VA and its state approving agencies to take action to limit or terminate the participation of institutions such as ours in existing tuition assistance programs. In several cases, these groups have received significant financial support from third parties critical of our sector and have aligned on messaging that negatively impacts our sector during policy and rulemaking discussions. In addition, the current administration has made student loan forgiveness one of its top domestic policy objectives, and it has been aggressively pursued by the Department in cooperation with special interest groups, other federal agencies, State AGs and others. These groups collectively have focused efforts relating to student debt forgiveness on for-profit colleges and universities, encouraging loan discharge applications and complaints by former students.

We continue to see one of the most challenging operating environments in recent memory as the Department has undertaken a complete overhaul of almost all of the major regulatory requirements associated with our participation in Title IV Programs and which disproportionally negatively impact the for-profit postsecondary education sector. Additionally, a number of the Department’s regulatory initiatives are explicitly targeted at negatively impacting the proprietary sector of education. In many cases the new regulatory requirements are unclear, require further clarification as to their interpretation or applicability or are subject or will be subject to legal challenges. We expect to continue to need to operate nimbly in this uncertain environment, making necessary changes to the extent possible to comply with the myriad of new vague or unclear rules or interpretations as well as new interpretations of existing rules. For example, in 2023, we materially reduced prospective student enrollment, marketing and outreach processes at AIUS during the year to limit the volume of new federal funding that the institution would receive and to preserve available funding for existing students under the Department’s new 90-10 Rule.

These are certainly large risks, but I think they are somewhat mitigated by several factors: first, the company has been responding to them for several years now; second, the company’s target demographics is older adults who should be more financially responsible; and third, the company is moving towards corporate partnerships and the like which is quite different than going after unemployed students. All that said, however, regulatory risk is very real and suggests taking a smaller-sized position than one might otherwise.

As to the risk of insider sales, I just don’t see it in the data, whether one looks at a total number of shares held or percentage of shares held.

Summary

I believe that PRDO is trading at very low valuations due to perceived risks and lack of historical growth. While the risks are real, I believe that the company is adept at dealing with them and that it has a plan to initiate moderate growth. Moreover, I think the company is focused on rewarding shareholders, both by implementing share buybacks and dividends. As such I rate the company a “Strong Buy” but have only taken a medium-sized position given the regulatory risks that are likely to be continuously operative.