Global Trade Finance Market

Dublin, March 06, 2024 (GLOBE NEWSWIRE) — The “Global Trade Finance Market by Product (Commercial Letters of Credit, Guarantees, Standby Letters of Credit), Transaction (Domestic, International), End User – Forecast 2024-2030” report has been added to ResearchAndMarkets.com’s offering.

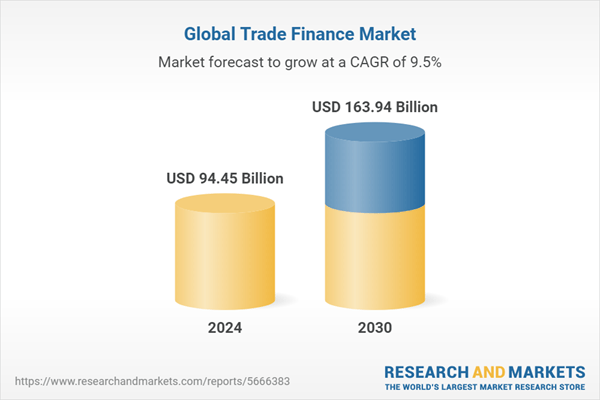

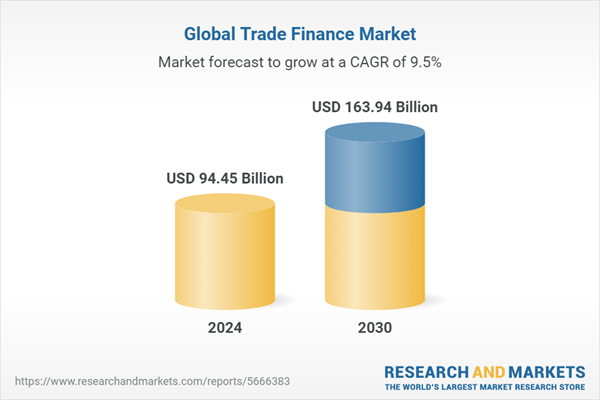

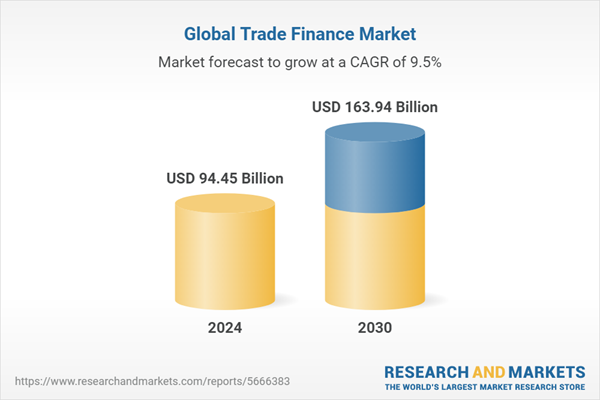

The Trade Finance Market size was estimated at USD 86.61 billion in 2023, USD 94.45 billion in 2024, and is expected to grow at a CAGR of 9.54% to reach USD 163.94 billion by 2030.

The Market Share Analysis is a comprehensive tool that provides an insightful and in-depth examination of the current state of vendors in the Trade Finance Market. By meticulously comparing and analyzing vendor contributions in terms of overall revenue, customer base, and other key metrics, we can offer companies a greater understanding of their performance and the challenges they face when competing for market share. Additionally, this analysis provides valuable insights into the competitive nature of the sector, including factors such as accumulation, fragmentation dominance, and amalgamation traits observed over the base year period studied. With this expanded level of detail, vendors can make more informed decisions and devise effective strategies to gain a competitive edge in the market.

Key Company Profiles

The report delves into recent significant developments in the Trade Finance Market, highlighting leading vendors and their innovative profiles. These include AlAhli Bank, ANZ Bank, Banco Santander S.A., Bank of America Corporation, BNP Paribas S.A., Citigroup Inc., Commerzbank AG, Credit Agricole, Deutsche Bank AG, Euler Hermes Group, HSBC Holdings PLC, ICBC, Japan Exim Bank, JPMorgan Chase & Co., Mitsubishi UFJ Financial Inc., Morgan Stanley, NatWest Group PLC, Riyad Bank, Standard Chartered, UniCredit S.p.A., and Wells Fargo & Company.

Market Segmentation & Coverage

This research report categorizes the Trade Finance Market to forecast the revenues and analyze trends in each of the following sub-markets:

-

Product

-

Transaction

-

End User

The report offers valuable insights on the following aspects:

-

Market Penetration: It presents comprehensive information on the market provided by key players.

-

Market Development: It delves deep into lucrative emerging markets and analyzes the penetration across mature market segments.

-

Market Diversification: It provides detailed information on new product launches, untapped geographic regions, recent developments, and investments.

-

Competitive Assessment & Intelligence: It conducts an exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players.

-

Product Development & Innovation: It offers intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

-

What is the market size and forecast of the Trade Finance Market?

-

Which products, segments, applications, and areas should one consider investing in over the forecast period in the Trade Finance Market?

-

What are the technology trends and regulatory frameworks in the Trade Finance Market?

-

What is the market share of the leading vendors in the Trade Finance Market?

-

Which modes and strategic moves are suitable for entering the Trade Finance Market?

Key Attributes:

|

Report Attribute |

Details |

|

No. of Pages |

180 |

|

Forecast Period |

2024 – 2030 |

|

Estimated Market Value (USD) in 2024 |

$94.45 Billion |

|

Forecasted Market Value (USD) by 2030 |

$163.94 Billion |

|

Compound Annual Growth Rate |

9.5% |

|

Regions Covered |

Global |

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

4.1. Introduction

4.2. Trade Finance Market, by Region

5. Market Insights

5.1. Market Dynamics

5.1.1. Drivers

5.1.1.1. Increasing number of international trade activities

5.1.1.2. Need for safety and security of trade activities

5.1.1.3. Surging adoption of trade finance by SMEs

5.1.2. Restraints

5.1.2.1. Issues related to trade wars and high cost of implementation

5.1.3. Opportunities

5.1.3.1. Technological advancements and digitization in trade finance

5.1.3.2. Rising investment and strategic alliances to develop trade finance

5.1.4. Challenges

5.1.4.1. Scarcity of trade finance for developing and low-income countries

5.2. Market Segmentation Analysis

5.3. Market Trend Analysis

5.4. Cumulative Impact of High Inflation

5.5. Porter’s Five Forces Analysis

5.6. Value Chain & Critical Path Analysis

5.7. Regulatory Framework

6. Trade Finance Market, by Product

6.1. Introduction

6.2. Commercial Letters of Credit

6.3. Guarantees

6.4. Standby Letters of Credit

7. Trade Finance Market, by Transaction

7.1. Introduction

7.2. Domestic

7.3. International

8. Trade Finance Market, by End User

8.1. Introduction

8.2. Banks & Financiers

8.3. Importers & Exporters

8.4. Insurers & Export Credit Agencies

9. Americas Trade Finance Market

10. Asia-Pacific Trade Finance Market

11. Europe, Middle East & Africa Trade Finance Market

12. Competitive Landscape

12.1. FPNV Positioning Matrix

12.2. Market Share Analysis, By Key Player

12.3. Competitive Scenario Analysis, By Key Player

13. Competitive Portfolio

For more information about this report visit https://www.researchandmarkets.com/r/ihqz3n

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900